Shares price of Caesars Entertainment Corporation is chaotically surging and slumping after The Wall Street Journal reported billionaire Carl Icahn intends to persuade the casino operator to put its stocks on the market.

On Friday, Caesars’ stock (CZR) rose approximately 2% following Icahn’s intention to induce the shareholders to sell the company, but at the end of the trading day it fell to 3%, reaching the minimum stock value for the first time since February 1. The fluctuation continued throughout the day, showing steep rises and declines in price.

Caesar’s stock value peaked in February 2014 when it was being traded at around $26 per share, whereas in November 2012 CZR depreciated to the lowest level ever and was available for less than $5 per share. Given the Icahn’s plans, CZR prices are currently balancing between $9.25 and $9.7.

Caesars Entertainment has received two offers for sale over the last year: one coming from Eldorado Resorts Inc., and another — from Golden Nugget Inc. Both offers were dismissed by the casino operator.

Caesars is deemed to be one of the most recognizable gambling organizations in the world, featuring more than 50 casinos located in 13 states and five countries. Its net income in the third fiscal quarter of 2018 amounted to $110 million, whereas in the same quarter of 2017 Caesars suffered a net loss of less than $400 million, according to Q3 18 official earnings report. To date, the company’s value is estimated at $6 billion, according to WSJ.

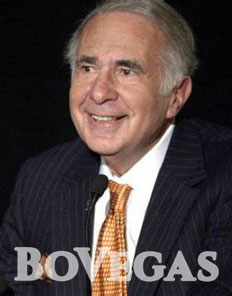

Carl Icahn previously had experience in the casino industry, investing in such gaming resorts as Sands Atlantic City in New Jersey, Stratosphere in Las Vegas, and Trump Taj Mahal in Atlantic City. He is also known as the founder of Icahn Enterprises and an economic adviser on financial regulations to US President Donald Trump. Icahn is one of Wall Street’s “most successful investors” who has been shaking up corporate America for decades, Forbes magazine previously reported. It’s also stated that Icahn’s net worth is estimated at $17.8 billion, which puts him in Forbes top 400.

WPTDeepStacks is among the world’s major poker tournaments held by the World Poker Tour, which also includes the exciting Rock and Roll Poker Open. If you had the misfortune of missing all the thrilling poker action at Deauville, read all about it in our review! World Poker Tour Deepstacks Deauville Deauville is a beautiful place […]

As you probably already know, five-card draw poker has long since given way to Texas Hold’em, as the latter is generally considered the number one game worldwide. However, it used to be rather a popular pastime in the Wild West, when nearly every cowboy was ready to match their strength with each other at the […]

People have been gambling all the time, on every continent, and in every type of society. Don’t ask us why. We just do not know. What we know is that the majority of the games are too old to be traced down to their roots and origins. But mankind has always tried to solve all […]

The penultimate World Poker Tournament of the current year will take place at the Seminole Hard Rock Hotel & Casino, with a guaranteed award of $2 million up for grabs! The WPT Seminole Rock ‘N’ Roll Poker Open is one of the WPT tournaments that serves to mark the end of the year for poker […]

If you love gambling and have been to a land-based casino at least once, you may have thought about becoming a dealer. Playing the same game but from the opposite side, while communicating with other players, sounds like a dream job, right? A dealer is a straightforward job, and you will be the heart and […]

On Monday September 14, MGM announced that it plans to open its first smoke-free casino at the end of September, when Park MGM will finally reopen its venues to players and tourists. The resort comprises around 2,990 rooms and various restaurants, and it’s set to be reopened on September 30. The venue has been closed […]

Online gambling has undoubtedly taken a place of true supremacy over the casino industry during the pandemic. And the reason for that is quite clear: online casinos are more accessible, and you can always count on some encouragement from the casino administration to help you boost your game. However, this digital revolution has only been […]

The large selection of online gambling sites out there can make players somewhat puzzled, and give them a feeling of uncertainty about making the right choice of casino. Each online gambling venue offers its own conditions, games, and various bonuses, of course; but the most important thing is the reliability of the casino and the […]